The Forecasting Power of Twitter Sentiment on Future Stock Performance

Senior Capstone Senior year 2016-2017

My undergrad senior capstone project is in Business Analytics, which analyzes whether the sentiment of Twitter’s tweet content towards specific companies can be an indicator of their stock prices. Particularly, I am comparing the predictability of tweet sentiment in both consumer-facing and nonconsumer-facing companies’ stock values.

Abstract

Social media are increasingly reflecting and influencing behaviors of other complex systems. In this paper, I investigate whether Twitter's tweet sentiment (aka: tweet sentiment) can forecast firm specific stock performances. In particular, I compare, in a period of 62 days, tweet sentiment's predictive power on stock performance in both customer-facing companies and non-customer-facing companies. I want to explore whether tweet sentiment correlates with individual stock prices and returns differently depending on whether the company is customer-facing or non-customer-facing. Therefore, I analyze 5 customer-facing companies and 5 non-customer-facing companies. My hypothesis is the following: Negative tweet sentiment can more accurately forecast individual firm’s future stock performances than positive tweet sentiment. Non-customer-facing companies’ stock performances correlate with tweet sentiment more significantly than customer-facing companies’ do. However, my research finds that in the short term, there is little predictive power of tweet sentiment on stock performance at an individual firm level, and the Efficient Market Hypothesis holds.

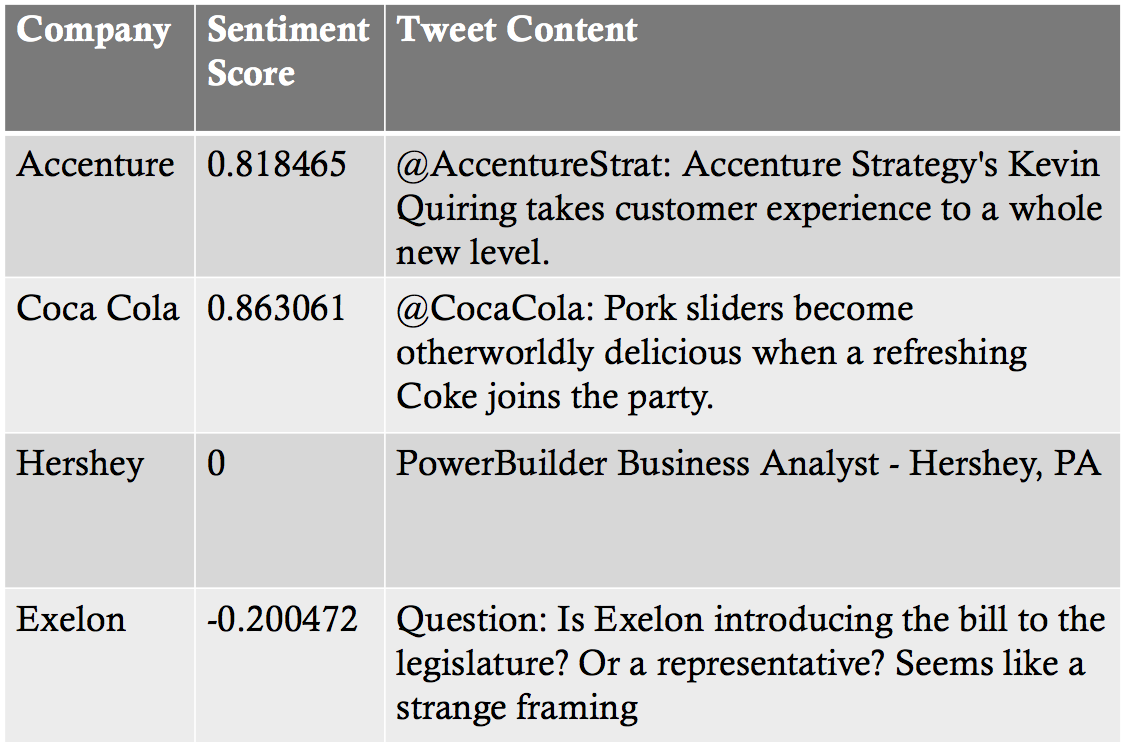

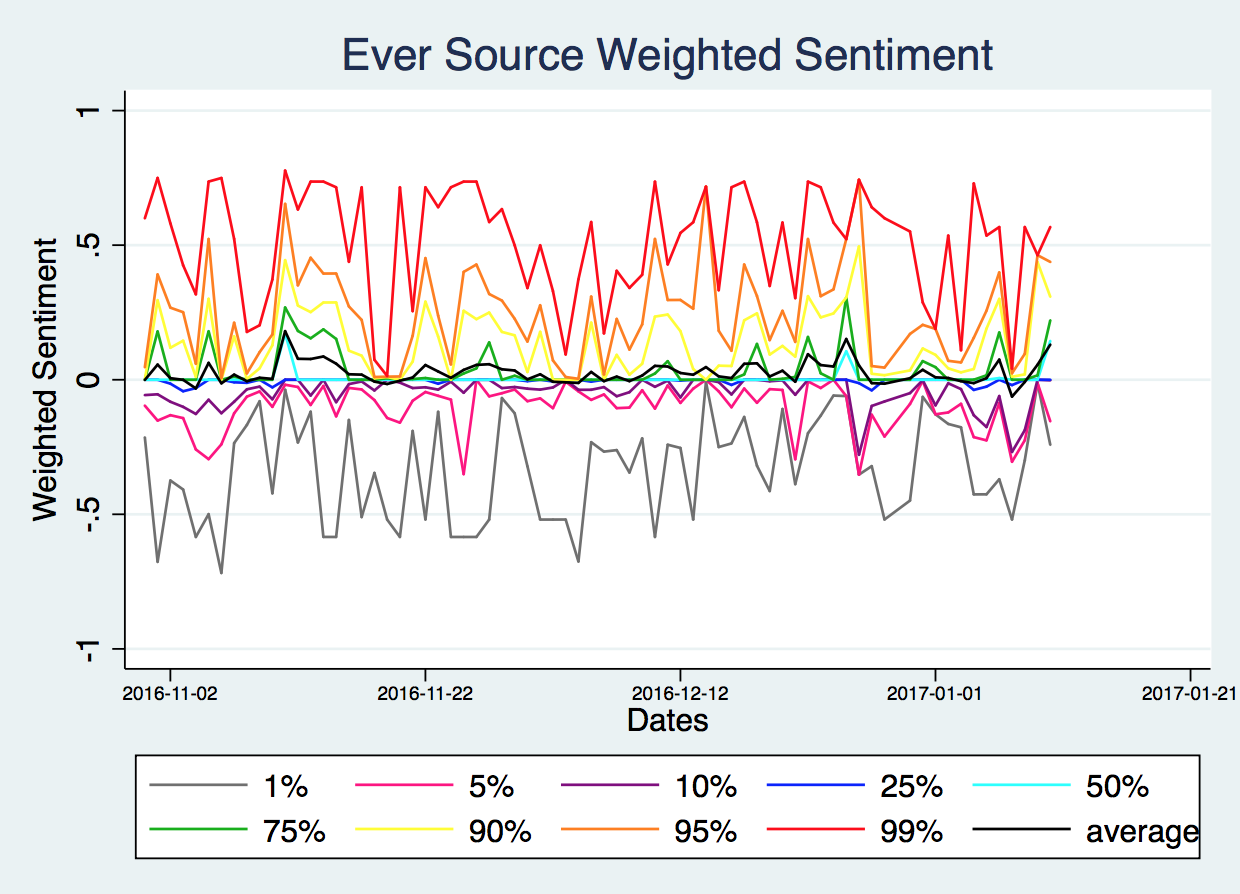

The above image on the left is a sample of the tweet content and their sentiment score analyzed by Microsoft API. The image on the left graphs the weighted sentiment volatility of different percentiles in a two-month period. Ever-source is a non-customer facing energy company.

Full Capstone

Full Capstone